Ekzaga for Dummies

Wiki Article

8 Simple Techniques For Ekzaga

Table of ContentsNot known Details About Ekzaga The Of EkzagaFascination About Ekzaga7 Simple Techniques For Ekzaga

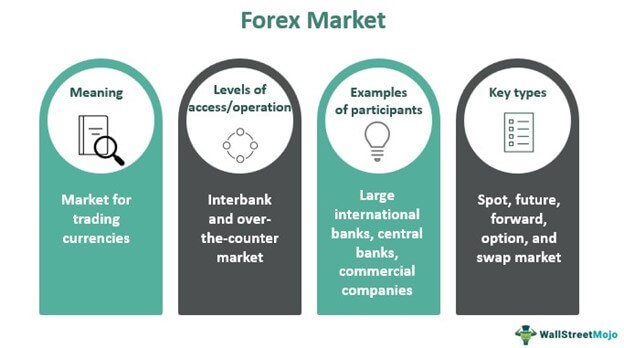

The forex market mostly exists for catering the currency requirements of exporters, importers, and tourists. Unlike equity markets, the currency market is not an investor oriented market. Investors are a must for an equity market to operate. Rather, a capitalist needs the presence of the Forex market to make overseas investments.

The Forex market is needed for the complying with critical features that drive the economic climate of a country. Merchants will certainly have a requirement to convert the settlements obtained from an overseas customer right into residential money. Importers will certainly have a need to convert the residential currency into the US dollar for buying goods abroad.

Also for the conclusion of a merger or an acquisition deal, a money conversion is a necessity. Such requirements can be fulfilled just with the Foreign exchange market. Numerous a times payments are sent out as financial tools (checks, need drafts, letter of credit histories, international fund transfers, and so on) from one nation to another.

Top Guidelines Of Ekzaga

When a country expands financing to an additional country for advancement tasks, line of credit are usually opened favoring business associated with the task. Even such instruments are processed utilizing the exchange prices dominating in the FX market. Also, a nation might have bought the financial obligation instruments provided by one more nation (as an example, United States Treasury notes) (more info).That indicates, the merchant might or may not recognize the actual quantity he planned to make while preparing the quote to the end customer. In the worst instance situation, a merchant might even sustain a loss. To avoid such unfortunate events, an exporter can secure the exchange price by participating in an agreement with the transacting financial institution, which will certainly utilize the Foreign exchange market to hedge the position as well as protect its passions.

When the economic situation of a country starts squashing, the central bank will certainly reduce rate of interest. That will certainly make the residential money unattractive to international investors. Main financial institutions will certainly likewise intervene (market the residential currency and acquire the book currency) in the Foreign exchange market, if required, to guarantee the residential currency continues to be weak.

What Does Ekzaga Mean?

That will enhance the good looks of the domestic money to abroad investors. If necessary, the main bank will intervene (buy the domestic money and also sell the reserve money) in the Forex market and make certain the residential money continues to be solid.That will certainly avoid overheating of the economic climate. Therefore, main financial institutions can make use of the Foreign exchange market to reinforce or weaken the domestic currency, if necessary, and guarantee smooth performance of the economy. The globe economic situation would stop without the Forex market, as there would certainly not be a correct device to identify the currency exchange rate of currencies.

The currency exchange rate represents how much of the quote currency is required to purchase one unit of the base money. Each money is represented by a three-letter code, with the initial 2 often referring to the nation and the 3rd describing the money as an example USD for the US dollar, CAD for Canadian buck as well as NOK for Norwegian krone.

0001 in the cost of a money pair. Usually called a "pip" indicating a market or property cost in decline traders that expect prices to drop as well as may be holding brief settings the difference in between the buy cost and the sell rate the cost at which an investor can offer indicated a market or property cost that is climbing an investor who anticipates rates to increase and also might be holding lengthy Clicking Here placements jargon term for the GBP/USD currency set the second currency in a money pair - in USD/EUR the euro is the counter currency an individual in a deal entering and leaving a forex profession on the exact same day.

How Ekzaga can Save You Time, Stress, and Money.

margin is associated with leverage, as well as represents the minimal quantity of money you require to down payment to trade at your specified utilize when your open position actions versus you, your broker will certainly make a margin require you to supply added funds to cover your margin an energetic trade mean "cost interest factor" and also is the tiniest quantity whereby a currency pair's price can change (best day trading platfrom).0001. this is the distinction in between the bid - or market - rate, and also the ask - or acquire - rate on a money set. alternate name for the UK pound a minimal adjustment in cost, or a pip FX prices rise and fall frequently throughout the day, based on whether one money remains in greater need than the various other. https://bookmarkswing.com/story15477711/ekzaga.

Report this wiki page